The Gap and Go strategy is one of the most effective ways to invest during market hours. If favorable conditions prevail, you may be able to complete your trading day in 30 to 60 minutes. If the price of shares fluctuates between the close of the previous trading day and the opening of the next trading day, this is referred to as an overnight void.

The gap and go strategy occurs when a stock’s price gaps above the previous day’s close. Using a pre market scanner and searching for equities with premarket volume is the most popular approach for gap trading success. This is a widely utilized trading strategy among day traders. Each morning, pre-market scanners detect a number of stocks that have gapped up. Traders from all around the world are keeping a close eye on them to identify potential trading opportunities.

During today’s pre-market and post-market hours, the most prevalent scan logic accounts for fluctuations in market prices. Do you desire more information regarding the GnG strategy? Then let’s leave.

Table of Contents

What is a gap and go strategy?

Gap and go is one of the most frequently employed stock market trading tactics. As its name suggests, a gap and go trading strategy is based on a daily market phenomena. It depends on the type of market you are attempting to penetrate.

This is due to the fact that gaps are a common occurrence on the markets. When the price opens the next session higher or below the previous session’s close, a gap occurs. Large amounts of orders that drive up prices cause gaps in the market. In addition, it suggests a market imbalance.

In general, traders are accustomed to seeing prices progress in a consistent manner. For instance, today’s opening price would be comparable to yesterday’s closing price. However, there can be pricing gaps in some instances. These gaps are the result of robust market orders placed during the pre-markets and after-markets.

Trading gaps can be somewhat tricky. First, there is a proverb that says gaps are meant to be filled. This indicates that prices have a tendency to reverse and fill the gap with either a high or a low. Nevertheless, gaps can also serve as effective setups.

In numerous instances, gaps persist for extended periods of time. This can rely on whether the security can sustain its velocity after creating the gap and continue in the gap’s direction.

What are the gaps?

Gaps are instances on a price chart where the prices of financial instruments open significantly below or above the previous close. This indicates that prices of financial assets open with a gap below or above the previous session’s close. In other words, prices rise following the formation of a gap or termination. For instance, the stock of the corporation concludes a trading session at $10. When the next session begins, the market opens at $12. What exactly is it? It is the gap we discussed a moment ago. The stock price should have opened at $11 per share. However, it proceeds directly to $12 without mentioning $11. It actually created a gap above.

How can you recognize a price chart gap? By observing the candlesticks, you can discover a gap. Between two candles, a missing piece is readily visible. In addition, gaps can occur in virtually all markets, including stocks, currencies, commodities, and exchange-traded funds (ETFs).

Why are there gaps in the financial markets?

Several factors, both technical and fundamental, contribute to the establishment of gaps. The most prevalent and significant reasons include:

Economic data

Economic data may trigger gap formation. If the US produces positive economic statistics, for instance, the odds of a gap between the EURO and US pair increase.

Earnings

Profits also contribute to gap formation. For instance, if a business produces strong earnings, its stock price may build a huge gap above the market.

Other causes

Mergers and acquisitions, analyst selections, the involvement of a major investor such as Warren Buffet, etc., are further noteworthy causes.

Understanding why gaps occur is purely for your own knowledge. It is unnecessary to discover why the gap occurred. However, it is essential to discover a gap and exploit it for optimal results.

Three varieties of gap

There are many names for gaps within the bullish and bearish gaps dependent on where they occur.

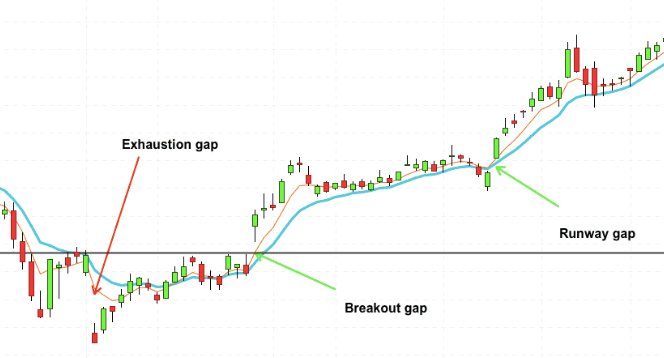

Breakaway gap

According to its name, the breakaway gap often arises at the beginning of a trend. Here, the price tends to deviate from the preceding closing price, resulting in gaps. When analyzed in the context of the preceding trend, the breakaway gap has greater validity.

Obviously, a breakaway gap is only true if price continues to move in the same direction as the breakaway gap and maintains the trend.

Runway gap

The gap in the runway occurs in the middle of a trend. When this gap arises, the markets are indicating that further gains are possible. A runway gap can be identified by evaluating the market’s general trend.

Even better is when the trend coincides with a breakout gap and is supported by an already existing trend. However, once the runway gap arises, you should be cautious since it may indicate that the price has limited room to move.

Exhaustion gap

Obviously, the tiredness gap is the final step. In this case, the price tends to gap after the trend has been established. It is the final price surge before prices begin to consolidate or signify a trend change.

Exhaustion gaps can only be justified in retrospect, and there is no assurance that the tendency will reverse simply because an exhaustion gap has appeared. It is the commercial situation that must be taken into account.

Advantages of Gap and Go strategy

When you consider the benefits of the Gap and Go strategy, it becomes evident why many like it over earlier day trading techniques for managing their stocks on the financial market.

Having access to pre-made scans facilitates the discovery of the most profitable market open trading setups. Consequently, you should experience profitable returns.

In addition, you can choose conventional scanning with a normal brokerage account. These will also be pretty handy for your stock market trading day.

Considering all elements, it is evident that the Gap and Go strategy has a great deal of promise for managing price fluctuations. Moreover, it should generate positive returns when the market opens.

Disadvantages of Gap and Go Strategy

As with any other trading strategy available, the Gap and Go strategy has disadvantages.

Due to the possibility of enormous stock gaps on the open market, price volatility may be high. Consequently, trading stocks will include uncertainty.

Due to the probability of negative effects on price movement, you will need to personally determine the reason for the stock gaps.

However, you should take this with a grain of salt because each trader on the stock market favors unique market open trading tactics.

Undeniably, some of you will find the Gap and Go strategy to be the most effective.

How to trade the Gap and Go strategy?

With the gap and go strategy, you essentially ride the price momentum of an asset. The strategy is straightforward. Wait for the market to open and watch for the security to gap up or down. In many situations, this information can be found in the pre-market opening session, which will alert you to the day’s major movers before the market opens.

Once you’ve determined which stocks have gapped upward, you can buy them. Similarly, you can go short if the stock has gapped downward. Stops are put within a few ticks of the opening price. Profits are achieved by simply trailing your stops until you are completely out of the market.

One advantage of the gap and go strategy is that if you are incorrect, the markets will rapidly reveal it. In many instances, the stops are quite close, but the potential for profit can be enormous.

The gap and go trading strategy is perfect for day traders and scalpers. Traders have refined this simple strategy with additional filters. For instance, depending on the volatility of the security you are trading, you may disregard small gaps.

Before entering a trade, some traders prefer to utilize moving averages and the overall trend. If the gap happens in the direction of the trend, it is regarded as more trustworthy than if it occurs in the opposite direction of the trend.

What should you take into account before placing a trade?

Simply said, the Gap and Go strategy entails riding the price movement of an item. It is a simple strategy, but you must be cautious when searching for a gap that can be exploited to make money. Moreover, to enter a trade, you must act swiftly and study all the signs. The following three essential factors are helpful in this regard.

1. Volume

As you are aware, volume is one of the most essential metrics, and it is readily accessible to you. Traders must understand the significance of high or low volume, particularly when entering a trade at a support or resistance level. For instance, volume indicates whether or not bulls will sustain dominance. This indicates if the price will be able to surpass the resistance and rise. Similarly, the volume indicates whether the price will continue to rise after developing a gap above.

2. Volatility

Volatility is another crucial part of trading that everyone must understand. Occasionally, more volatility results in price fluctuations that are both unforeseen and substantial. Why so? Because it is impossible to predict when emotions will improve in technical analysis. When it occurs, wild market fluctuations ensue. Volatility should therefore be kept in mind.

3. Risk tolerance

Prior to engaging in trading, traders must establish their risk tolerance as a matter of vital necessity. When you have a specified risk tolerance, it is simple to establish stop-loss levels when trading using the Gap and Go strategy. How do you mitigate your risks? Despite the fact that the Gap and Go strategy is often seen as very profitable because prices frequently climb after building a gap above, this is not always the case. Nevertheless, trading is a field where anything can occur at any time. Therefore, it is essential to be prepared for any situation. Consequently, it is essential to manage your risks with stop-loss orders. The ideal method for determining where to place stop-loss orders is to consider the risk-to-reward ratio. Herein lies the significance of your predetermined risk tolerance. Thus, you can easily determine where to place stop-loss orders.

These three factors will allow you to rapidly examine the situation and enter the trade with ease.

Tips for the gap and go trading strategy

Here are the most important points to keep in mind when trading gaps:

Once a stock has begun to close the gap, it will typically continue to do so because there is typically no immediate support or resistance.

Exhaustion gaps and continuation gaps forecast price movement in opposing directions; therefore, you must accurately classify the gap you intend to trade.

Institutional investors may partake in irrational enthusiasm to benefit their portfolios; therefore, be cautious when using this indication and wait for the price to begin to break before entering a position.

Be mindful of the loudness level. Breakaway gaps should have high volume, while exhaustion gaps should have low volume.

How to profit from the gap and go strategy?

Examining all gaps that are 4 percent or greater

Traders with experience utilize pre-market scanning tools. They are platforms that present traders with thousands of trading scenarios. As AI programs, they discover which market links have predictable outcomes. They determine what works in a rising or falling market. In addition, it proposes to traders what to purchase, what to short, and when to abandon the market.

Seeking out catalysts

Today, technology has not only made it possible for traders to deal with different marketplaces from anywhere in the world, but it has also enabled professionals to share ideas on comparable platforms. When searching for news, earnings reports, and public relations, traders utilize social media platforms such as StockTwits, Market Watch, and Benzinga. After confirming a catalyst, the following step is to search for an entry.

Note the pre-market peaks

Investors and traders typically observe pre-market trading activity to gauge the market’s strength and direction. This is performed in preparation for the regular trading session. Even though premarket trading has limited volume and liquidity, it provides a fantastic opportunity for traders to make substantial bid-ask spreads. It is usual for seasoned traders to begin pre-market access at 8 a.m., when volume increases. This is the case for stocks with a gap up or down due to rumors or news.

Prepare to purchase pre-market highs

In this phase, traders prepare to place orders on pre-market highs. It is typical for experienced traders to choose rapid and simple transactions. This occurs between 9.30 and 10 a.m. EST, which is why profits are typically realized by 10 a.m.

Buy expensively as soon as the market opens

When trading begins at 9:30 a.m., you must buy on the high breakout of the 1 minute opening range with a stop at the low. This will help you to profit in half an hour by taking advantage of pre-market highs.

How do you know if a stock will gap up?

Unquestionably, the best technique to determine whether a stock will gap up is to use a stock scanner. I recommend searching the pre-market each morning for stocks with a minimum gap-up of 3 percent and a premarket volume of 100,000 shares or more. Apply a filter and hunt for stocks with a news catalyst. Why? There is a significant possibility that stocks with pre-market activity and a news catalyst will gap up at the open!

The stock changes from red to green during the day, hence the name red to green. Additionally, you might employ gaps as an option trading strategy.

When a stock’s color changes from red to green, it may continue its upward trend. Red-to-green transitions are closely watched by traders.

Traders also enjoy buying on dips to reduce their trading risk. We instruct the gap strategy and how to trade it in our live trading room. Check out our trading service for additional details.

Does it matter why a stock gapped up or down at the opening of the market?

The most common reason for a gap in individual stock stocks is earnings announcements and company news, although general market news can affect the entire financial market.

When looking for a Gap and Go strategy with high continuation momentum of the gap-direction, you must understand why the stock gaps. If there is merely broad market news or a reason that is uncertain, avoid placing any buy or sell orders.

You must understand the cause in order to determine whether the news has sufficient force to maintain the price movement. Don’t forget that supply and demand are constantly at play.

You must avoid being the last individual in line before prices reverse direction.

Additionally, remember. News causes change. Not the technological installations themselves Numerous day traders are content to trade a simple breakout or breakdown. But if there is no news to support it, the surge will be short-lived or the markets may drift sideways.

Importantly, the price change should be supported by significant news. TheFly.com, Briefing.com, and Benzinga.com make it simple to search for news.

Most other news websites provide delayed news data, which is useless for real-time trading. The news always precedes the Gap & Go price change; never the other way around.

Conclusion

On the financial markets, the Gap and Go strategy is one of the most essential and lucrative trading techniques. Its execution is contingent on a specific market condition in which a financial asset opens above the previous session’s close. The Gap and Go strategy is basically based on locating such assets and riding the rally. The strategy is relatively straightforward to implement and only requires you to consider a few factors. However, you must evaluate clues quickly and respond instantly. When utilizing the Gap and Go strategy, dependable pre-market scanners are valuable assets. It is therefore a straightforward strategy. It is also rather simple to implement. However, it provides you with benefits beyond your wildest idea.